Home > Payments > Create a Payment Schedule > help for this step > step 3 create payment schedule

ASAP Help

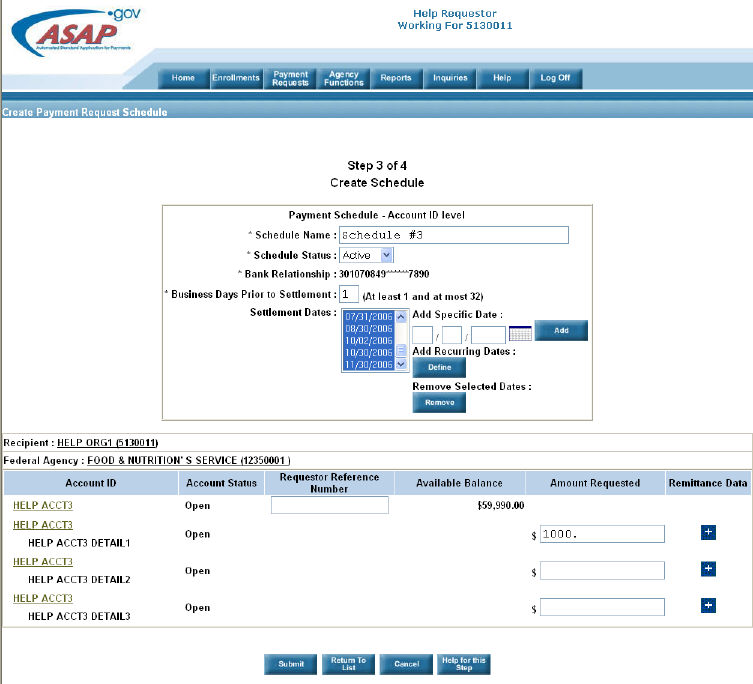

The purpose of the third step is to create the schedule attributes associated with the payment request.

Click here to see Screen Graphic

Create the payment schedule at the Account ID level by specifying the following:

1. Schedule Name

· The Schedule Name must be unique for the Requestor .

o The bank relationship must support ACH.

2. Business days prior to settlement

· This is the number of business days prior to settlement that the payment request will be initiated. If the request will be held for Agency Review , it is recommended that the number of days be sufficient to allow time for the agency to take action .

· If the account is not eligible for warehoused payments, the number of days will automatically be set at 1. If warehoused payments are allowed, the number of days can be manually set at between 1 and 32.

3. Settlement Dates

· Specific dates can be added by entering the date and clicking Add.

· Recurring dates can be defined by clicking Define. (See DEFINE RECURRING DATES)

· Highlighting the Settlement Date and clicking Remove can delete dates previously added or defined.

4. Enter an optional Requestor Reference Number.

5. Enter the Amount Requested for the Account or Account Details .

6. Enter optional Remittance Data

· See ‘INITIATE PAYMENT REQUEST – REMITTANCE DATA’ for more information on entering Remittance Data.

· Please be aware that, when making an ACH transaction, the Detail IDs of Control Accounts and Global Control Accounts are not sent to the financial institution with the ACH transaction. Only the parent Account ID is sent to the financial institution. Remittance data is one way to track these payments made via Detail IDs. Please see tips & tricks for more information.

7. Click Submit .